Edward Jones Login & Edward Jones Security Detail 2024

How do I find my Edward Jones account?Is there an app for Edward Jones?How do I change my Edward Jones password?Is Edward Jones online?Why can’t I log into my Edward Jones account?What is a Edward Jones single account?edward jones credit card login,edward jones.ca login,edward jones near me,edward jones website down,edward jones employee portal,principal login,edward jones security,edward jones reviews

Edward Jones to Deploy MoneyGuide Software to All U.S. Advisors

In the course of a $1 billion technological investment programme, a brokerage firm will give its advisors a financial planning tool.

The financial services company Edward Jones is raising its technology spending and progressively making third-party financial planning from Envestnet | MoneyGuide available to its more than 17,000 advisors in the United States, according to a statement. In some circumstances, the newly available software will be used to replace components of the firm’s existing financial planning software, Financial Foundation, which is currently in use.

Personnel, technological infrastructure, virtual business tools, and “test and learn pilot projects” are among the investments the brokerage plans to make over the course of the year in order to position the firm on a competitive footing.

Edward Jones intends to use the funds to “rebuild our cloud infrastructure” and “move away from mainframe [technology],” according to Frank LaQuinta, the company’s chief information officer. He went on to say that the investment is intended to equip advisers with better-advising platforms, strengthen their mobile infrastructure, empower them with more tools through partnerships, and improve the firm’s overall cybersecurity.

According to him, the funds would also be utilised to recruit new leadership and technology staff. David Chubak, a former Citigroup retail services executive, was one of the company’s first employees to be disclosed. Chubak has been promoted to the position of president of Edward Jones’ wealth management division.

According to LaQuinta, the $700 million in technological investment made last year will be added to the $700 million committed in similar categories this year.

MoneyGuide is the only specific tool mentioned in the announcement and subsequent interview with LaQuinta, and it is only referenced once. The popular planning tool will be implemented in phases, with full access to the programme expected to be available by 2025 for all U.S. advisors.

The staggered deployment is consistent with Edward Jones’ “test and learns” methodology, in which small groups of advisers co-design the adoption of new technologies with the company’s corporate headquarters. Together, the team seeks to understand how the new technology fits into the firm’s services model—if it does so at all—and then to figure out how to best implement the new technology so that advisors can provide services that distinguish them from their competitors while also allowing them to spend more time with their clients.

“Test and learn” will be the strategy for new technology implementation at Edward Jones “in the future,” according to LaQuinta.

According to materials on the firm’s website, the principles underpinning MoneyGuide should be recognisable to the firm’s advisors, who have up until now utilised a proprietary goals-based software called Financial Foundation, which is currently being phased out. The tool assesses end clients’ risk tolerance, net worth, and cash flow, and it provides them with goal tracking as well as projections of the future values of their investment portfolios. Advisors are taught how to facilitate sessions involving financial planning.

DO NOT MISS: TD Bank Login & TD Bank Customer Services Detail 2023

According to Edward Jones spokesperson Regina DeLuca-Imral, “MoneyGuide will replace specific components of Financial Foundation while enhancing others that will stay in place.” “All financial advisors will provide advice and counselling through the unified Financial Foundation/MoneyGuide platform” by 2025, according to the Financial Foundation.

Despite widespread speculation, executives at Edward Jones rebuffed the notion that the company’s technological investments were a reaction to the reality of remote working and digital cooperation brought on by the pandemic. In 2019, the firm established a permanent “Transformation Office,” which is directed by Kristin Johnson and is tasked with improving the business’s approach to financial counselling, as well as its technological capabilities. Edward Jones, according to Johnson, has the potential to grow its client base from approximately 7 million to 40 million people in North America with the appropriate approach.

Advisors will be able to scale their businesses with the support of new technologies and improved workflows. “A great deal of change in behaviour was prompted by the pandemic.” According to LaQuinta, the company already has “increased collaboration” and “digital enablement tools” on its to-do list. In fact, “because our strategic strategy was always aggressive,” the pandemic just hastened the uptake of our product.

“We’re increasing our investment because of the success that we’re witnessing from our branch staff, as well as the satisfaction that our clients are experiencing,” he continued. “We’re simply moving at a faster pace.”

Edward Jones said that it will begin rolling out a set of new prospect and client interaction tools in August 2020, with a target launch date of December 2020. Starting Point, Edward Jones Match, My Priorities, and Webinar Hub were among the four applications included in the package.

Edward Jones Review

The use of free or low-cost services, such as Robo advisers, by some people, is a way to save money on investing advice. Not that there’s anything wrong with it.

However, if you choose to chat with a live person, such as a financial counsellor, the cost would be more. More money is required if you wish to be able to walk into your local advisor’s office and deal with the same advisor on each and every occasion.

Edward Jones is a financial services company that specialises in the latter. The fees charged by Edward Jones have received a great deal of criticism. Is it really such a bad deal after all? In this essay, we’ll discuss who Edward Jones is truly for, as well as whether or not the high costs and negative customer ratings are justified.

Who Is Edward Jones?

Individuals and small businesses of all sizes can benefit from the investing services offered by Edward Jones. It was founded in the year 1922. According to the company, Edward Jones serves almost 7 million investors and has the largest retail presence of any financial services organisation in the United States. It also services clients in the United States and Canada.

Penny Pennington is the Chairman and CEO of Edward Jones. She also serves as the sixth managing partner of the company. Pennington stated on the Edward Jones History page that the company was founded for the benefit of its clients and that its mission is to “make a difference in their lives and in the lives of their families.”

What Do They Offer?

Edward Jones (EJ) is a full-service investment brokerage firm that provides a wide range of services. This means that it provides services in the areas of estate planning, financial planning, retirement planning, 529 plans, life insurance, long-term care planning, and annuities. Investors with any level of net worth can participate in EJ.

This essay will focus on the numerous negative evaluations that EJ receives, as well as the idea that it charges excessive rates. High costs are relative; nonetheless, the fees charged by EJ are unquestionably higher than those charged by online-only bargain brokerages or robo advisers. Even when compared to the costs charged by certain financial services firms that give human financial counselling, EJ’s prices are significantly higher.

What exactly is going on here? Is it possible that they are simply scamming people? In a nutshell, no. We need to go a little deeper into the situation in order to figure out what is going on.

YOU MAY LIKE THIS: Tubi Tv Activate: Tubi Tv Activate Code & Tubi Tv Sign In Detail 2023

High Fees

Some of the products that Edward Jones sells, such as life insurance and annuities, have hefty costs associated with them. However, this will be true at any other firm that offers the same financial products as the one in question.

What do you think about stock trading? If you’re comfortable with self-directed trading, you may not require the services of a full-service brokerage firm. However, if you decide to go with EJ and register a “Select Account,” you will almost definitely pay a significant premium. The following commissions will be charged to you in addition to the $4.95 trade transaction fee:

According to EJ, between 36 and 40 per cent of these commissions are paid directly to the advisor or firm. It should be noted that by selecting one of EJ’s five asset-based fee pricing models, you can avoid paying the trade commissions mentioned above entirely. In order to avoid these large transaction costs, you must pay a significant percentage of your assets under management, as we will see later.

It is very evident that EJ is primarily aimed at individuals who desire hands-off financial and investment management. This means that these individuals do not have the time to conduct stock research, rebalance their portfolios, or even understand how to manage their respective portfolios. EJ can take care of everything for them.

Additionally, EJ delivers a level of human engagement that is much different from that provided by other companies. Many organisations restrict you to only meeting with an advisor over the phone, or, in the best-case scenario, you can video call with your advisor to discuss your options. However, you may not always work with the same advisor, which means you will have fewer opportunities to develop a connection.

Edward Jones has a very different approach to human engagement than most other companies. Despite the fact that you can call your EJ adviser on the phone, you can also visit their local office and meet with the advisor in person. In addition, this is the same advisor each and every time. The EJ approach enables its advisers to establish rapport and long-term connections with a small number of clients.

Poor Reviews

You can find a big number of negative reviews about Edward Jones posted all over the internet. A common complaint is that the fees are too exorbitant, that they are losing money, and that they are not getting anything in return for their money.

People who compare EJ management costs to those charged by robo advisers appear to be the most typical source of negative feedback on the site. The fact remains, however, that these are two very separate services for two completely different categories of investors. Thus, a comparison between them is not truly “apples to apples” in terms of fruit quality.

Other consumers have expressed dissatisfaction with the commissions and fees charged by EJ for stock trades. To be clear, Edward Jones is not a suitable fit for those who want to do their own investing. It exists to suit the needs of customers who wish to meet with a financial advisor in person who can assist them in preserving their cash while also generating a reasonable return.

Edward Jones Login & Edward Jones Security Detail 2023

Account Types

Edward Jones has six distinct account tiers to choose from. In the graphic below, you can see a fast comparison of the account minimums, investment options, and support levels of each financial institution.

| Investment Minimum | Investment Choices | Who Makes Final Trade Decisions? | Advisor Compensation | |

| Select Account | $0 | Stocks, bonds, CDs, mutual funds, ETFs, annuities | You | Commission |

| Guided Solutions Fund Account | $5,000 | Mutual funds, ETFs | You | Asset-Based Fee |

| Guided Solutions Flex Account | $25,000 | Stocks, bonds, CDs, mutual funds, ETFs | You | Asset-Based Fee |

| Advisory Solutions Fund Models | $25,000 | Portfolio models (Mix of mutual funds and/or ETFs) | Advisor | Asset-Based Fee |

| Advisory Solutions UMA Models | $500,000 | Portfolio models (Mix of mutual funds, ETFs, and/or separately managed allocations) | Advisor | Asset-Based Fee |

Are There Any Fees?

Select Accounts require you to pay only trading commissions when you purchase or sell investments, and you do not have to pay any other fees. Edward Jones will charge a percentage of assets under management for all other accounts, with the percentage varying depending on the account size.

| Value of Assets | Advisory Fee |

| First $250,000 | 1.35% |

| Next $250,000 | 1.30% |

| Next $500,000 | 1.25% |

| Next 1,500,000 | 1.00% |

| Next 2,500,000 | 0.80% |

| Next 5,000,000 | 0.60% |

| Over 10,000,000 | 0.50% |

EJ additionally charges a “Portfolio Strategy Fee” for its two most expensive account tiers (Advisory Solutions Fund and UMA Models), in addition to its other fees. Once again, the amount of this fee fluctuates depending on the size of the account, as indicated below.

| Value of Assets | Advisory Fee |

| First $250,000 | 0.09% |

| Next $250,000 | 0.09% |

| Next $500,000 | 0.08% |

| Next 1,500,000 | 0.07% |

| Next 2,500,000 | 0.06% |

| Next 5,000,000 | 0.05% |

| Over 10,000,000 | 0.05% |

If you open your first retirement account with Edward Jones, you’ll pay a $40 yearly fee, and another $20 for each new IRA you open (the price is waived if the account’s value exceeds $250,000). Additional expenses such as dividend reinvestment and dollar-cost averaging may be imposed to retirement funds.

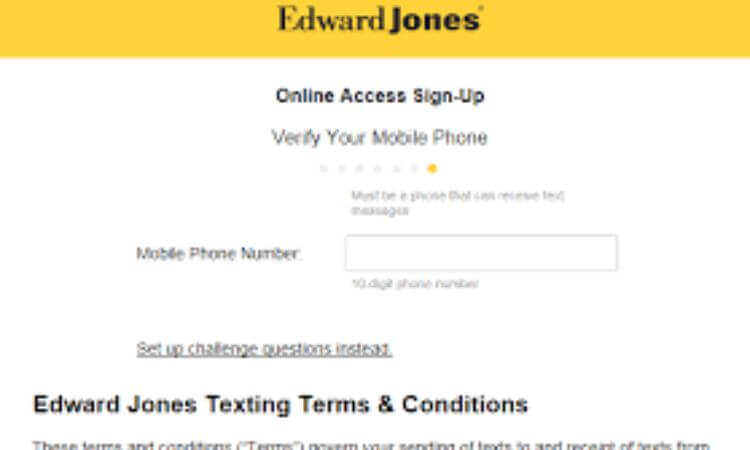

Edward Jones Login

Open an account at your local Edward Jones branch by visiting their website. You can search for the EJ office that is nearest to you using their “Find a financial advisor” function, which allows you to enter your zip code.

Is It Worth It?

The fact that Edward Jones charges such high fees is undeniable. However, it provides an opportunity to get valuable experience that is not available at every organisation. If you prefer to work with a single advisor who can develop a long-term, in-person relationship with you, EJ may be a good option for you.

In most cases, getting recommendations from trusted friends and colleagues is the best way to choose a financial advisor. If you have such folks in your immediate circle who use EJ and are satisfied with it, that can be a good option for you. Just keep in mind that there may be other fiduciary financial advisors in your area who charge lesser fees than the one you are currently working with.

In the event that you are comfortable with having your investments managed by a computer algorithm, it is unquestionably true that the majority of robo-advisors are much less expensive than EJ’s services. Finally, if you desire the ability to make your own trading decisions, you should consider comparing budget stock brokers instead of full-service brokers.

Edward Jones Features

| Account Types |

|

| Minimum Investment |

|

| Management Fees |

|

| Portfolio Strategy Fees |

|

| Trade Transaction Fee | $4.95 |

| Trade Commissions |

|

| Access to Human Advisor | Yes |

| Automatic Rebalancing | Yes, for Advisory Solutions accounts |

| Tax-Loss Harvesting | Yes, on Advisory Solutions UMA Models accounts |

| Customer Service Number | 1-800-441-2357 |

| Customer Service Hours | Mon-Fri, 7 AM – 7 PM (CT) |

| Mobile App Availability | iOS and Android |

| Promotions | None |