Synchrony Bank Login and Synchrony Bank Credit Card Detail 2023

mysynchrony payment,synchrony financial,synchrony bank credit card,synchrony care credit login,amazon synchrony login,synchrony amazon,care credit login,synchrony bank customer service

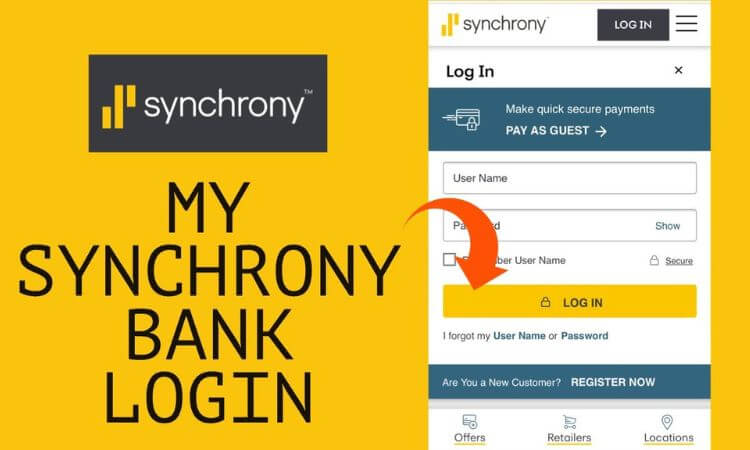

Synchrony Bank Login

Since its inception as the consumer lending arm of General Electric in 1932, Synchrony Bank has grown into a stand-alone financial services corporation. The company went public in 2014 as a public offering. In addition to offering a variety of retail credit cards, it offers online-only consumer banking, similar to that of other financial services organizations. Because Synchrony does not have physical branches, it is critical that you feel comfortable banking on the company’s online platform.

How To Log In to Your Synchrony Bank Account From a Computer

Logging into Synchrony from your computer is a straightforward and straightforward procedure.

- Visit SynchronyBank.com to learn more.

- It’s important to note that there are several Synchrony websites, including Synchrony.com and MySynchrony.com, so be sure you’re viewing the consumer banking website.

- To sign in, go to the top right corner of the screen and click the “Sign In” button.

- If you do not already have a Synchrony account, you can create one by clicking the “Open Account” button, which is located directly to the left.

- Input your username and password into the appropriate fields, then click the “Sign In” button.

How To Log In to Your Synchrony Bank Account From a Mobile Phone or Tablet

You can also use the mobile app to access and manage your Synchrony Bank account information.

- Synchrony Bank can be found in the Apple Store or Google Play if you search for it.

- Install the MySynchrony application on your device.

- When the app has completed downloading, open it and follow the on-screen instructions to log in.

How To Retrieve a Forgotten Username or Password

If you have misplaced or forgotten your Synchrony Bank login information, you can recover it by following these simple instructions.

- On the Synchrony Bank login page, select “Sign In.”

- Links for “Forgot your login or password” can be found just below the standard areas for username and password. Select the one that applies to you from the drop-down menu.

- For each option, you’ll be asked to verify your identity by entering your Social Security number and birthdate, which you should do immediately.

How To View Your Synchrony Bank Statement Information

If you have misplaced or forgotten your Synchrony Bank login information, you can recover it by following these simple instructions.

- On the Synchrony Bank login page, select “Sign In.”

- Links for “Forgot your login or password” can be found just below the standard areas for username and password. Select the one that applies to you from the drop-down menu.

- For each option, you’ll be asked to verify your identity by entering your Social Security number and birthdate, which you should do immediately.

DO NOT MISS: OneMain Financial Login & OneMain Financial Customer Service Detail 2023

How To Contact Synchrony Bank If You Have Trouble With Your Account

If you need to get in touch with Synchrony for assistance, you have a number of choices.

- Visit SynchonyBank.com, where you can pick “Contact Us” from the menu bar at the top of the site, and then select the financial product that you require assistance with.

- If an agent is available, you will be able to participate in a live chat with them from there.

- Please call 1-866-226-5638 with any questions if you want to communicate via phone.

- Individuals who are deaf or hard of hearing will need to make use of an operator relay service to communicate.

- Written correspondence is preferred, so please send your correspondence to the following address:

- Synchrony Bank

P.O. Box 105972

Atlanta, GA 30349-5972

What Are the Benefits of Online Banking?

Customers who are ready to forsake the more traditional parts of banking in person will find that online banking offers a number of significant advantages over traditional banking. The most obvious benefit is that most banks provide access to your account at any time of day or night, allowing you to do many basic transactions around your schedule rather than having to rely on bankers’ business hours.

In addition, and probably more importantly, online banks such as Synchrony, which do not have to bear the costs of maintaining physical branches, can offer higher interest rates on items such as savings accounts than traditional banks. Furthermore, many of the top online banks provide their customers with free and dependable mobile banking apps, which means you’ll be able to manage your money from virtually anywhere at almost any time with less effort.

Synchrony Bank Review

In addition to being an online-only bank, Synchrony Bank is a good choice for customers who want a high annual percentage rate to help them build emergency funds or achieve specific savings goals.

Synchrony Bank Product Details

Here’s more information about the various items that Synchrony Bank has to offer.

Synchrony Bank Savings Account

The Online High Yield Savings Account from Synchrony Bank is a good option to investigate. There are no minimum balance requirements or service fees associated with this account. Additionally, it is a high-yield account that provides an annual percentage yield (APY) of 0.60 percent across all balance categories, allowing your savings balance to grow more quickly. Additionally, the bank will reimburse account holders for out-of-network ATM fees up to $5 per statement cycle if they use an ATM that is not affiliated with the bank.

Synchrony Bank Money Market Accounts

Synchrony Bank offers only one type of money market account: the money market account. Having the option to issue checks directly from your savings account is advantageous if you want to avoid having to go through a financial institution. This account has no minimum amount or fees, and it offers a competitive annual percentage yield (APY) of 0.40 percent across all balance categories, as well as ATM access.

Synchrony Bank CD Accounts

More information on why GOBankingRates has ranked Synchrony Bank as being one of the Best CD Accounts of 2022 can be seen below.

CDs from Synchrony Bank do not have a minimum balance requirement and are available for maturities ranging from three months to sixty months. A 15-day rate guarantee is included with every CD, ensuring that you receive a rate increase if the annual percentage yield (APY) increases during the first 15 days after creating the account. Here’s a breakdown of the terms and interest rates available across all balance tiers:

Synchrony Bank Login and Synchrony Bank Credit Card Detail 2023

| TERM LENGTH | APY |

| 3-month CD | 0.25% |

| 6-month CD | 0.50% |

| 9-month CD | 0.60% |

| 12-month CD | 1.00% |

| 13-month CD | 1.10% |

| 14-month CD | 1.10% |

| 15-month CD | 1.10% |

| 18-month CD | 1.35% |

| 24-month CD | 1.60% |

| 36-month CD | 1.80% |

| 48-month CD | 1.80% |

| 60-month CD | 2.15% |

Best Features of Synchrony Bank

Synchrony Bank is an online bank, which means that all transactions must be completed through the bank’s website or mobile app. Before obtaining a Synchrony bank account, you should be familiar with the digital banking environment. Synchrony received an overall grade of 4.8 from GOBankingRates based on the following noteworthy elements that contribute to the overall banking experience.

Monthly Service Fees

When you can locate a financial institution that does not charge any service costs, it is always advantageous. Furthermore, because Synchrony is an online bank, it does not have the overhead costs that traditional brick-and-mortar banks do. Synchrony Bank’s deposit accounts, whether they are savings, money market, or certificate of deposit (CD) accounts, do not charge monthly service fees, ensuring that the income earned on your accounts remains in your accounts.

Minimum Opening Deposits

Depending on the bank and the type of account, the minimum opening deposit might range from $0 to thousands of dollars, or even higher. At Synchrony Bank, on the other hand, there are no minimum opening deposits necessary, including for certificates of deposit. Opening multiple accounts at the same time and making progress toward your savings objectives is made easier when there is no requirement to achieve a minimum balance requirement while making deposits.

Rates

When it comes to deposit accounts, Synchrony Bank offers competitive rates on all of its accounts, which can help you build your savings balances more quickly than if you banked at a competing financial institution that offered lower interest rates. Its Online High Yield Savings account offers an annual percentage yield of 0.60 percent on all amount tiers, while its Money Market account offers an annual percentage yield of 0.40 percent. CDs from the bank offer competitive rates of up to 2.15 percent, making them a good investment.

Mobile Experience

Synchrony Bank’s mobile app is accessible in the App Store and Google Play, where it has received ratings of 4.8 and 4.5 stars, respectively, based on customer reviews. You may use it to monitor your account balances, deposit checks, open new accounts, and transfer funds across accounts. Even better, you now have the option of viewing your account balances without signing into your account. You may set up a widget on your phone to display balances on your home or lock screen, and you can even grant Siri or Google Assistant permission to reveal your balances when they ask.

During the login procedure, account access is protected by the use of fingerprint and facial recognition technology. Also available on the app is the ability to communicate with a banker in real time, allowing you to get immediate answers to your questions.

Synchrony Bank vs. Competitors

A Synchrony Bank review should include a comparison of the bank’s goods and services to those of other financial institutions. Here’s how it compares to some of its main competitors.

Synchrony Bank vs. Ally Bank

Both banks provide above-average interest rates on certificates of deposit and savings accounts. If you’re only interested in a savings product that’s separate from your regular checking account, Synchrony may be a better choice because it will reduce the temptation to transfer funds between the two accounts. You should consider Ally if you want to handle all of your banking in one location and benefit from the broader selection of goods it offers.

Synchrony Bank vs. Citibank

In addition to the Step Up CD and No Penalty CD, Citibank offers a larger selection of CDs. Synchrony’s CD APYs, on the other hand, are as high as 2.15 percent, giving it a slight advantage. The maximum annual percentage yield on a CD offered by Citibank is merely 0.30 percent.

Synchrony Bank vs. Chase Bank

Chase offers a bewildering selection of certificates of deposit (CDs), with durations ranging from one month to ten years in length. Customers looking for a short- or long-term certificate of deposit might choose Chase. However, Synchrony Bank’s CDs offer a higher annual percentage yield (APY) of up to 2.15 percent, which can result in better returns than Chase’s top rate of 0.05 percent APY.

Conclusion

Customers who don’t mind having their savings accounts separate from their checking accounts will find Synchrony Bank to be a reasonable option to consider. Despite the fact that the bank does not provide many options, the accounts it does provide have interest rates that are higher than the national average. If you’re putting money aside for a special event or large purchase, you should consider opening a Synchrony Bank account.

Synchrony Bank FAQ

Answers to some of the most frequently asked questions about Synchrony Bank may be found below.

Is Walmart a shareholder in Synchrony Bank?

No. Synchrony Bank is a financial institution that operates on its own.

Is Amazon a part of the Synchrony Bank family of companies?

No. Synchrony Bank, on the other hand, is the issuer of Amazon Store cards and secured credit cards.

How can I get in touch with Synchrony Bank?

You can reach the bank by phone at 866-226-5638, which is available 24 hours a day, seven days a week.