Fidelity Login, Fidelity Bank Login, Fidelity 401k Login Detail 2023

fidelity netbenefits login,fidelity investments,fidelity bank login,fidelity 401k login,fidelity customer service,watchlist fidelity login,fidelity trade

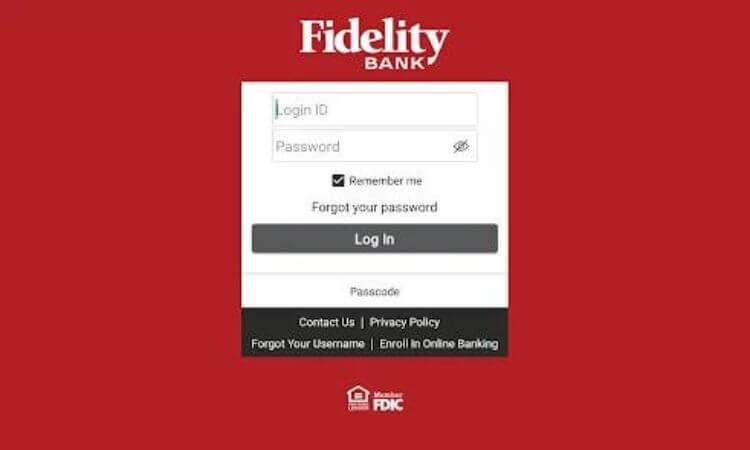

Fidelity Login

For example, many financial companies, such as Fidelity Investments, have methods for reclaiming your login credentials. Fidelity Investments is a well-known wealth management organization that provides its customers with a wide range of financial products, such as its Fidelity 401(k) and individual retirement plans, among other things. Your Fidelity account, like so many other goods and accounts these days, may be accessed and managed through the internet.

Creating a Fidelity Account

The following information will be necessary before you can set up a brokerage account, which is required in order to create a username and password.

- Identifying information such as social security number

- Date of birth is required.

- Contact information (email address)

- Contact information (phone number and mailing address)

- If appropriate, please provide details about your employment.

In order to fund accounts, you will also need to provide any required banking details. If you are transferring assets from another brokerage firm to Fidelity, you will also need the account information for the assets you are transferring.

Create Your Fidelity Account Login

As soon as you register for an account, you’ll be able to create a Fidelity Investments login account. The process of registering is quite straightforward. Your brokerage account will be verified, and then you will be prompted to create your login credentials.

Once you’ve completed the necessary steps, you can access Fidelity online. If you ever forget your Fidelity password, you may quickly retrieve it by giving details about your account. You can use the same login and password across all of Fidelity’s service channels, including:

Fidelity.com offers brokerage accounts, personal retirement accounts such as IRAs, and other financial services.

NetBenefits.com: Employer-sponsored funds such as 401(k), 403(b), health plans, pensions, and payroll are examples of what is available.

Charitablegift.com is a website dedicated to charitable gift fund accounts.

You can also access Fidelity agents over the phone by using the same username and password combination.

These requirements are applicable to all accounts you would open, including your Fidelity 401(k) account login. Customers can additionally benefit from the following security enhancements provided by Fidelity:

Text message security alerts

Authentication using two factors Integrity MyVoice is an acronym that stands for “My Voice is an acronym that stands for (voice recognition security).

DO NOT MISS: Discover Bank Login, Discover Credit Card Login, Discover Card Sign In Detail 2023

Fidelity Review

Fidelity provides investors with the best of both worlds in a number of ways. In addition to providing great self-directed trading capabilities — both web-based and mobile — Fidelity also stands ready to help clients with broker assistance that is only a phone call away. Despite the fact that Fidelity is not the cheapest broker available, the variety of products and services available, as well as the high quality of research and support, may offset the modest fees that most investors will experience. To determine if Fidelity is a good fit for your financial needs, consider the company’s advantages and disadvantages in comparison to other brokerage firms.

Fidelity at a Glance

A quick rundown of some of the features and specifics of Fidelity is provided here.

| Fidelity at a Glance | |

| Account Minimum | $0 |

| Stock Commission | $0 |

| Option Commission | $0 + $0.65 per contract |

| Commission-Free ETFs | Yes |

| Zero Transaction-Fee Mutual Funds | Yes, also zero expense ratio index funds |

| Investment Selection | Mutual funds, IRAs, stocks, fixed income investments, bonds, CDs, ETFs, options, sector investing, cash management and credit cards, managed account, 529 college savings, annuities, life insurance and long-term care, charitable giving, managed portfolios, international trading in 25 countries and 16 foreign currencies |

| Customer Service | Live chat, Fidelity branches, 24/7 phone support |

| Mobile App | Yes, with real-time quotes and extensive features |

| News and Research | Extensive research, including the Fidelity Learning Center |

| Miscellaneous Fees | Fees for nearly all account services are $0 |

| Current Promotion | Up to 500 free trades for two years |

Individual Services Reviews

The range and quality of a broker’s services are what distinguish it from the competition. Check out how Fidelity does in a number of key service categories below.

This information can be used to do an apples-to-apples comparison between Fidelity and other brokers in order to determine which platform offers the greatest overall package for your investing needs.

Fidelity Login, Fidelity Bank Login,Fidelity 401k Login Detail 2023

Trading Experience

Fidelity offers three different degrees of trading for investors with varying levels of experience: novice, intermediate, and advanced. A number of basic features are included with the standard interface, including mobile and online trading, as well as free webinars and events, virtual group coaching sessions, and discounts on advanced tax software.

A step up is Fidelity’s Active Trader Services, which is available to traders with at least $25,000 invested who make 120 or more stock, bond, or option trades over the course of 12 months. More active traders will benefit from access to ActiveTrade Pro and WealthLab Pro, which provide additional technology, such as real-time alerts and analytics, for those who use this platform to trade. Customers will also receive a complimentary copy of the Turbo Tax Premier online program.

Active Trader VIP is available to traders who have a portfolio worth at least $1 million and have executed 500 or more deals in the previous 12 months. Traders at Fidelity may be reached directly through Active Trader VIP, which also offers a slew of additional technological benefits in addition to the full range of Active Trader capabilities.

Account and Investment Minimums

Fidelity does not have any account minimums or requirements for a minimum initial investment.

Commissions and Fund Expenses

Fidelity generally offers competitive commissions and fund charges, and this is true for the most part. Online equities trades are free, but options contracts are charged at a rate of 65 cents per contract. These prices are comparable to those charged by some other brokers who do not charge for online trades, but they are significantly lower than those charged by many large businesses which charge $6.95 or more for each trade.

Fidelity’s Automated Service Telephone, often known as FAST, can be used to conduct phone trades. The cost of a stock trade is $12.95, while the price of an option contract is an additional 65 cents per contract. In the case of broker-aided trades, the charge increases to $32.95 + 65 cents per contract and $32.95 plus 65 cents per contract, respectively.

Commission-free offerings are available from Fidelity in the ETF and mutual fund segments. It is possible to purchase all exchange-traded funds (ETFs) at the firm without incurring a commission, including iShares ETFs, Fidelity sector funds, Fidelity active fixed-income funds, Fidelity factor funds and more.

All Fidelity funds can be purchased without incurring any fees, and a handful of funds are available that do not impose transaction fees. Please keep in mind that if you sell these funds within 60 days of purchasing them, you will be charged a $49.95 fee. Alternatively, more money can be purchased for a $49.95 commission, with no redemption costs charged at any point in time.

Trading Technology

Fidelity takes great satisfaction in the technology it has developed to improve pricing. Fidelity saves investors an average of $17 for every 1,000-share equities order, and it also gives the amount by which deals were enhanced once they have been confirmed. An impressive 94.74 percent of shares are enhanced at Fidelity, with an average execution time of 0.05 seconds. With its price optimization capabilities, Fidelity saved investors a total of $635 million in only one year in 2018.

Usability

It’s fair to say that the Fidelity interface has suffered as a result of its popularity. On the good side, there’s an almost limitless amount of information available, ranging from research and market insights to investment possibilities, advice, and services, among other things.

Although all of this information is valuable, it may be too much for some customers to handle. For example, when you hover your cursor over a large number of options, drop-down menus flood the screen, making it difficult to identify exactly what you’re looking for. Many useful resources may be found on the website, but it is important to acquaint yourself with how it operates before using it for the first time.

Mobile and Emerging Tech

Although the website is more functional in some areas, Fidelity’s mobile applications for both Android and iOS devices are superior in other aspects. For starters, you have the option of customising your landing page and news feeds. The screen is also not cluttered with all of the information that is available on the website, which is a plus. But there’s no need to be concerned about losing out on anything because all of your vital information is synced across your app and website accounts.

You can also access real-time quotes, check your balances, and keep track of your watch lists without having to log into your account. Additionally, you can use the app’s useful Notebook feature to jot down notes about your present or potential holdings.

Range of Offerings and Investment Selection

Fidelity provides a diverse selection of investment options that are sufficient to meet the needs of both novice and experienced traders. The following are examples of investment options and products that are now available:

- IRAs invested in mutual funds

- Trading \sStocks

- ETFs that invest in fixed income securities such as bonds and CDs

- Options

- Investing in specific industries

- Cash management and credit cards are both important.

- Accounts that are being managed

- Savings plan for college (501(c)(3)).

- Annuities

- Life insurance and long-term care are two important considerations.

- Donations to charitable organizations

- Portfolios that have been managed

- The company conducts international business in 25 countries and 16 foreign currencies.

- Customers can invest in over 10,000 mutual funds through Fidelity, but the company does not yet provide bitcoin or futures trading services.

News and Research

Fidelity Investments features numerous news and research resources. You can keep track of watch lists, receive quotes and alerts, and read research papers on any section of the market – from stocks and bonds to fixed income, options, initial public offerings (IPOs), and everything in between. Screeners, filters, news, and insights, as well as other features, are included in the research for each market area. To continue your study beyond all of this, you can visit the Fidelity Learning Center, which offers articles as well as courses, webinars, and events.

Customer Service

Fidelity customer care is available 24 hours a day, seven days a week through phone assistance. Live chat isn’t available 24 hours a day, seven days a week, but it is available from 8 a.m. to 10 p.m. EST throughout the week and 9 a.m. to 4 p.m. EST on Saturdays and Sundays. Despite the fact that Fidelity offers all of the advantages of an online brokerage, you may also visit one of the company’s Investor Centers, which are situated throughout the United States, if you prefer to chat with a financial representative in person.

Security

Fidelity protects customer information by utilizing encryption, firewalls, encrypted email, and proactive 24/7 account surveillance to help keep it safe. In addition, the organization uses two-factor authentication and security text alerts to protect the identity of its clients. The Fidelity Customer Protection Guarantee ensures that any financial damages incurred as a result of unlawful activity in customer accounts will be reimbursed.

Costs

As of October, Fidelity provides trading at a rock-bottom cost of $0, matching the low rates offered by some of their competitors. ETFs and mutual funds can be purchased at no cost, and Fidelity provides a long number of complimentary services that would otherwise be charged at a premium at other firms.

Fidelity, for example, does not charge fees for bill payments, stop payments, ATM use, bank wires, insufficient funds, or outbound account transfers, among other things.

How to Make a Withdrawal From Your Fidelity 401k

With a Fidelity 401k, the money flows in only one direction: from your paycheck directly into your retirement account, possibly with matching funds from your employer if you’re lucky. However, despite all of your efforts to contribute to your 401k, there may come a moment when you will need to make a 401k withdrawal from your account.

In an ideal situation, the withdrawal will occur because you have achieved retirement and are ready to stop working for your money and start putting it to work for you instead. However, you may be required to make a 401k early withdrawal or a 401k hardship withdrawal if you are faced with unexpected financial difficulties.

The only way to be certain that you will not be penalized for withdrawing funds from your Fidelity 401k is to familiarise yourself with the company’s withdrawal policies. Here’s a look at the fundamentals of making a withdrawal from your Fidelity 401k, so you can feel confident about navigating the process.

Making a Fidelity 401k Withdrawal

Your 401k is your money, and withdrawing it is as simple as calling Fidelity and informing them that you choose to do so. The quickest and most straightforward method is to go to Fidelity’s website and request a check from there. If you want, you can also reach out to us by phone at 800-343-3543 if you have any questions regarding the procedure.

It is possible to download the relevant withdrawal request form from this website and then mail it in to the address specified in the form. Fidelity will process your request and have your check ready for you within five to seven business days of receiving it. The request for a check is free, but if you decide to liquidate any of your holdings, there may be commissions or mutual fund costs associated with that decision as well.

If You Are 59 1/2 or Older

Once you are six months away from reaching the age of sixty-one, you can begin withdrawing funds from your Fidelity 401k without having to worry about incurring any further tax consequences. Your 401k is now money that is available for you to use to begin preparing for the next chapter of your life as you put the finishing touches on your job and prepare to begin drawing Social Security payments after you have reached the age of retirement.

However, this does not rule out the possibility of having to deal with taxes in the future. If you take money out of your 401k, it is considered taxable income, so you should carefully assess how much you need to take out in any given tax year to avoid falling into a higher tax rate and seeing more of your hard-earned money go to taxes. The good news is that you can make tax-free withdrawals from your Roth IRA or Roth 401k, allowing you to spread your withdrawals out over time in order to reduce the tax impact.

Regular withdrawals from your Fidelity 401k are available, allowing you to complete the necessary documentation for your withdrawal only once and then set up a recurring payment schedule in your account. It is possible to set up a budget that will limit your withdrawals to only what you require, as well as to have checks arrive on a regular basis with planned, regular withdrawals.

If You Are Under 59 1/2

The decision to take a distribution from your Fidelity 401k before reaching the age of 60 should always be considered a last resort. Besides the fact that you would most likely face tax penalties in many circumstances, doing so will prevent you from reaping the great benefits of compounding. In order to handle any short-term cash needs, it is critical to establish an emergency fund, which can be used to avoid paying a penalty for taking an early 401k withdrawal.

The reality is that life has a way of throwing you curveballs that leave you with few to no alternative options. If you are truly in a financial bind, you can withdraw money from your account in the same way that you would remove money from any other account. It is filled out in a different way on each website, but you may locate it on Fidelity’s website and request a single check or numerous scheduled installments using it.

If you take advantage of this opportunity and begin taking withdrawals before the age of 59 1/2, you would have effectively breached your agreement with the government to invest that money for your retirement needs. As a result, you’ll be subject to tax penalties that might significantly diminish your nest egg before it ever reaches you.

A 401k early withdrawal entails a tax penalty of 10% of the amount of the withdrawal, in addition to the standard income tax that would have been assessed on the money. Even if you’re already receiving a typical salary, taking an early withdrawal might easily push you into a higher tax bracket, and you’ll still be subject to the additional penalty, making it an extremely expensive withdrawal.

401k Hardship Withdrawal

The good news is that there are a variety of different situations in which you can avoid the additional tax penalty. The IRS allows for a 401k hardship withdrawal in specific circumstances, such as a medical emergency or to pay for funeral expenses. If you qualify, you’ll still owe regular income taxes on the money you withdraw, but there will be no additional fines imposed by the government.

A few other exclusions exist that will allow you to take an early withdrawal without incurring an additional tax liability, subject to certain restrictions, such as paying for college tuition or purchasing your first house. Make sure you speak with a Fidelity representative prior to making a withdrawal to avoid paying any extra fees or penalties.