Ally Bank Login| Ally Bank Phone Number, Ally Bank Career Details 2023

Ally Bank Login| Ally Bank Phone Number, Ally Bank Career Details 2023 ally bank login ally bank locations ally bank account ally financial ally bank near me ally bank address ally bank invest ally bank wikipedia.

Ally Bank Login

Ally Financial is a bank holding corporation with its headquarters in Detroit, Michigan, and was founded in the state of Delaware. It offers a variety of financial services, including automotive financing, internet banking through a direct bank relationship, business loans, auto insurance, home mortgage loans, and an electronic trading platform for the exchange of financial assets.

As one of the leading automotive finance firms in the United States, Ally provides financing and leasing for 4.5 million consumers and originates about one million auto loans yearly. It is ranked among the largest banks in the United States in terms of assets, and it has a total of 2.0 million depositors. Its electronic trading platform has around 350,000 financed accounts, according to company estimates.

The company has sold more than 5 million vehicles through its SmartAuction online platform for auto auctions, which was started in 2000. In 2019, the company sold 270,000 vehicles through its SmartAuction marketplace.

Until 2010, the company was known as GMAC, which was an abbreviation for General Motors Acceptance Corporation.

Ally Bank Review 2023

Ally Bank is an excellent choice for people who are comfortable doing all of their banking online and who want access to loans, high-yield deposit products, and credit cards, among other things.

Ally Bank is a one-stop shop for online-only banking consumers from coast to coast who want to do everything in one place.

Ally is a well-established online bank that offers a wide range of deposit products, loans, and other services.

It offers low-cost deposit accounts with no monthly maintenance fees and no minimum balance requirements, as well as high-interest savings accounts.

Offers higher interest rates on certificates of deposit and savings accounts than traditional brick-and-mortar financial institutions.

Clients of Ally Bank have access to more than 43,000 ATMs worldwide through the Allpoint network.

Ally Bank does not have any physical locations.

Cash deposits are not accepted at this time.

Ally Bank offers a high-yield savings account that is continuously competitive in terms of interest rates. It doesn’t always offer the greatest annual percentage yield, but it is always in the top tier of rates. In order to open an account, there is no requirement to make a minimum deposit, and there are no monthly service costs. To access your funds, you’ll need to make an online funds transfer, wire transfer, telephone transfer, or request a check through the account because it doesn’t have an ATM card available.

Save for specific goals with buckets in your Ally Bank savings account, which you may access through your online savings account.

Ally’s Online Savings Account offers a competitive annual percentage yield (APY) on all balance tiers.

There are no monthly maintenance fees or minimum balance requirements associated with this account.

There is a function in the digital account that will assist you in saving money toward your various financial goals.

CDs are available at Ally Bank in three different types. The online bank offers high-yield certificates of deposit with a variety of terms, as well as a couple of bump-up certificates of deposit and an 11-month no-penalty certificate of deposit.

There is no requirement to make a minimum deposit in order to open any of the CDs. If interest rates rise within 10 days of creating and filling the accounts, customers may be eligible for the maximum interest rate (which varies depending on their balance amount and CD duration). Those who renew a CD will also benefit from an additional 0.05 percent loyalty reward from Ally, which will be applied to their account.

To open a CD, there is no requirement for a minimum deposit.

CDs are available in a variety of formats.

Early withdrawal penalties are less severe than those imposed by other financial institutions.

Some other online banks offer higher interest rates.

Ally Bank offers only one type of checking account: the checking account. This financial institution’s competitive Interest Checking account offers tiered interest rates; the yields fluctuate depending on the minimum daily amount maintained in the account each day.

In addition, there are no monthly account maintenance costs associated with the checking account.

Customers of Ally Bank checking accounts have access to more than 43,000 in-network ATMs through the Allpoint Network, which is a member of the Allpoint Network. In addition, at the end of each statement cycle, Ally will reimburse you up to $10 for fees charged at ATMs that are not part of the Ally network.

You can deposit checks online with the help of a scanner, or you can deposit checks using your smartphone using the Ally app. Each checking account comes with a set of complimentary checks as well as a debit card.

Customers can earn interest on whatever daily balance that they have available to them.

With the Interest Checking account, there is no requirement for a minimum initial deposit.

There are no monthly fees, and normal checks and debit cards are accepted at no additional cost.

Overdraft fees are not charged by Ally Financial.

Ally Bank is a virtual bank that does not have physical locations or accept cash deposits.

The Ally Money Market account offers a competitive interest rate on money market investments. In contrast to a savings account, a money market account offers free checks as well as a debit card for the account holder.

A money market account, rather than a savings account, maybe a better choice for those who need access to their money through ATMs and who wish to write checks from their accounts.

- The Ally Money Market offers a competitive annual percentage yield (APY).

- The account comes with a debit card as well as checks.

- Account-holders get refunded up to $10 every statement cycle for costs incurred at ATMs that are not affiliated with Allpoint.

- To open the account, there is no requirement to make a minimum deposit.

- Other online banks may offer accounts with annual percentage yields that are higher than Ally’s.

- In the event that an account does not receive funds within 30 days after account opening, it will be closed.

- Ally Bank does not have any physical locations, yet retail bank customers can speak with a person over the phone at any time of day or night. Customers can also find out how long they will have to wait for a phone call on Ally’s website. They can also communicate with one another through the live chat tool available online.

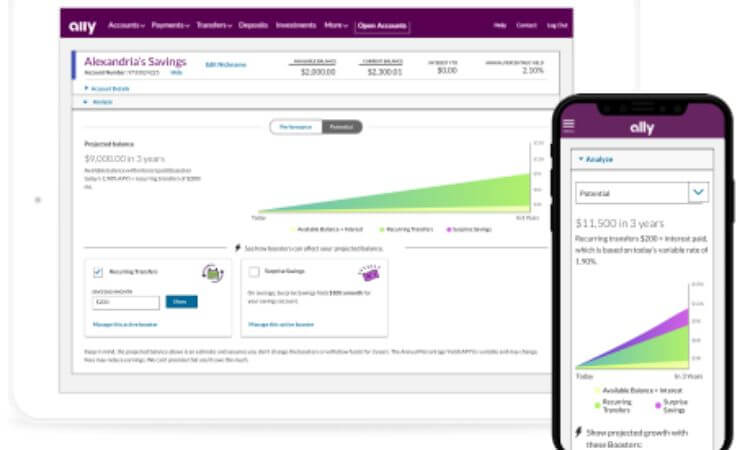

The Ally Bank mobile app has received a positive rating of 4.7 on iOS and a rating of 4.1 on Google Play, respectively. One function, which analyses customers’ checking accounts and automatically transfers money into their savings accounts when its algorithms conclude that it is safe to do so, encourages people to save more money in the long run.

Once known as General Motors Acceptance Corporation (GMAC), Ally Bank is an online bank that came out of the banking branch of the firm that was originally known as an auto financing company. GMAC Bank changed its name to Ally Bank in 2009.

Credit cards, home loans, money market accounts, investment products, certificates of deposit, checking accounts, and savings accounts are just a few of the products that the bank now offers to customers across the country. Ally Financial, the bank’s holding company, is a significant financial services provider with its headquarters in Detroit. It provides services to millions of retail customers as well as thousands of automotive dealerships in the United States.

DO NOT MISS: Ambetter Login | Ambetter Member Account Information 2023

Pros Explained

- In addition, Ally does not impose any monthly maintenance fees on its online savings, checking, money market, or certificate of deposit (CD) accounts, as long as the account is open for at least one month.

- High interest rates on savings and certificate of deposit accounts – Ally’s online savings account earns 0.50 percent annual percentage yield (APY), which is a higher interest rate than that offered by many traditional financial institutions. Its no-penalty CD account earns higher interest rates than CDs from most traditional brick-and-mortar financial institutions.

- In Ally’s bank accounts, there is no necessity to maintain a certain minimum balance.

- Ally customers have access to a large fee-free ATM network, which includes more than 43,000 fee-free AllPoint ATMs located throughout the United States.

Cons Explained

- Due to the fact that it is an online-only bank, customers do not have access to in-person services at local branch locations. If you like traditional brick-and-mortar banking services, you’ll have to go elsewhere for your banking needs.

- Ally does not take traditional cash deposits, and does not accept checks or money orders. The only alternatives available to you are remote check deposit, internet transfers, direct deposit, wire transfers, and mailing a check to the financial institution.

- Money market accounts have a low-interest rate – Ally’s money market account does not offer competitive interest rates in the same manner that other top online banks do, according to Consumer Reports.

Ally Bank Login Ally Bank Phone Number, Ally Bank Career Details 2023

Who Is Ally Bank Best For?

Individuals looking for a full-service online bank should find Ally Bank to be a good fit. In particular, it is a suitable fit for consumers who are looking to:

Earn attractive interest rates on savings accounts and certificates of deposit.

No fees are charged for access to ATMs.

You can bank without having to worry about minimum balances or monthly fees.

Contact a live customer support professional at any time of day or night.

What Does Ally Bank Offer?

Ally Bank is a full-service online bank that provides a wide range of banking accounts and services to its customers.

- Savings accounts

- Savings accounts

- checking accounts

- money market accounts

- certificates of deposit

Savings Account

Ally’s online savings account is a high-yield savings account that pays 0.50 percent annual percentage yield regardless of the amount of money in the account.

The use of an online savings account is a terrific technique to save money in order to achieve your financial objectives more quickly. The following are some of the other benefits of the savings account:

- There are no monthly payments for upkeep.

- There are no requirements for a minimum balance.

- Deposit envelopes with pre-paid postage

Transfers that occur automatically on a regular basis (to accelerate savings)

Withdrawals from Ally’s online savings accounts are subject to federal withdrawal limits. There is a combined limit of six withdrawals and transfers every statement period for certain withdrawals and transactions. Ally Bank charges a $10 fee for each transaction that exceeds the limit.

| Ally Bank Savings Accounts | |||

| Account Name | Min Opening Deposit | Monthly Fee | APY |

| Online Savings | $0 | $0 | 0.50% |

Checking Account

With its interest checking account, Ally provides a method to earn interest on your money. There are no minimum opening deposit or ongoing balance requirements, but interest rates are determined by the amount of money in your account at any one time.

- Minimum daily balances under $15,000 earn 0.10 percent annual percentage yield (APY).

- Minimum daily balances of $15,000 or more get a 0.25 percent annual percentage yield.

Ally’s online checking accounts include a free debit card and checks, as well as fee-free access to AllPoint ATMs located throughout the United States and Canada. Additional ATM costs from other financial institutions are reimbursed up to a maximum of $10 every statement period by Ally Bank.

Customers of Ally Bank’s interest checking accounts have access to free online bill payment features.

| Ally Bank Interest Checking | |||

| Account Name | Min Opening Balance | Monthly Fee | APY |

| Interest Checking | $0 | $0 | 0.10% if

< $15,000 0.25% if $15,000+ |

Money Market Account

Ally’s money market account offers higher interest rates than those offered by traditional banks, but the rates are comparable to those offered by other online financial institutions. All balances are now earning an annual percentage yield of 0.50 percent.

Money market accounts do not require a minimum initial deposit and do not charge monthly fees. The use of a debit card and the AllPoint ATM network is also provided at no cost to customers. Additionally, Ally will reimburse you for ATM fees from out-of-network machines up to a maximum of $10 every statement cycle. The number of withdrawals from an ATM is not limited, but there is a restriction of six additional transactions each month, with a $10 fee for each transaction that exceeds the limit. Money market accounts from Ally Financial include the ability to write checks.

| Ally Money Market Accounts | |||

| Account Name | Min Opening Deposit | Monthly Fee | APY |

| Money Market | $0 | $0 | 0.50% |

CDs

Ally Bank offers three different certificates of deposit (CDs):

- CDs with a high rate of return

- Increase your hourly rate. CDs

- There will be no penalty CDs.

- High-Yield CDs are available for a variety of durations ranging from three months to five years. Customers can earn up to 0.80 percent annual percentage yield (APY) depending on the conditions they choose. 4 There is no demand for a minimum deposit, and there are no monthly fees to pay. Early withdrawals are subject to penalties, which might include interest charges of up to 150 days.

| Ally Bank High Yield CDs | |

| Term | APY |

| 3 Months | 0.15% |

| 6 Months | 0.20% |

| 9 Months | 0.30% |

| 12 Months | 0.75% |

| 14 Months | 1.00% |

| 18 Months | 1.10% |

| 24 Months | 0.75% |

| 36 Months | 1.15% |

| 48 Months | 0.75% |

| 60 Months | 1.20% |

Increase your hourly rate. Customers who purchase CDs will be able to enhance their earnings if Ally’s interest rates rise. The rate on two-year certificates of deposit can be raised once, and twice on four-year certificates of deposit. Currently, the annual percentage yield (APY) on these CDs is 0.75 percent. There are no monthly maintenance fees to pay, and there is no requirement for a minimum opening deposit to be made. CDs with a higher interest rate are also subject to early withdrawal penalties, which can be as much as 150 days of interest.

| Ally Bank Raise Your Rate CDs | |

| Term | APY |

| Two Years | 0.75% |

| Four Years | 0.75% |

CDs with no penalty fees that generate up to 0.50 percent annual percentage yield. 6 Account users are free to withdraw both interest and principal monies at any time, beginning six days after funding their account, and there are no penalties for doing so. All No Penalty CDs have 11-month durations, do not require a minimum initial deposit, and do not charge a monthly service cost.

| Ally Bank No Penalty CDs | ||

| Term | Balance | APY |

| 11 Month | Less than $5,000 | 0.50% |

| 11 Month | $5,000 to $24,999 | 0.50% |

| 11 Month | $25,000+ | 0.50% |

Other Financial Products Offered By Ally Bank

Ally Bank also provides a wide range of additional products and services, including

- Auto loans

- Purchase mortgages

- Refinance mortgages

- Individual retirement accounts (IRAs)

- Self-directed trading

- Managed investment portfolios

Ally Bank Customer Service

When assistance is required, Ally Bank provides a number of options. The phone line is staffed 24 hours a day, seven days a week to assist you. Customers can also send secure communications to one another by logging into their online accounts.

Ally also provides live chat support on their website for those who require instant assistance. You can also send general correspondence to the following address:

Ally Bank Customer Service is located at P.O. Box 951 in Horsham, Pennsylvania 19044.

How to Bank With Ally Bank

You can apply for an Ally Bank account online at Ally.com if you choose to do so. Select the account choice that best suits your needs, fill out some personal information, and then select a funding method that works best for you. If and when your account is approved, Ally will send you an email. Ally Bank also provides the option of opening an account over the phone at any time of day or night, or by downloading and mailing in an application form.

Ally Bank Login

To access your Ally Bank online account from a computer, you must first create an account at allybank.com by creating a username and password for yourself. If you have an iPhone® or an AndroidTM smartphone, you may go into m.allybank.com or download our Mobile Banking app to access your account.

To obtain online access, create a new account online or call Customer Care Support at 1-877-247-2559 to get the process underway.

What’s an Online Banking password hint?

If you forget your password, you might use a word or phrase to remind yourself of it.

I’ve forgotten my username or password or my username is blocked. What should I do?

In the event that you have forgotten your Ally Bank username or if it has been blocked, you can contact us at 1-877-247-2559 at any time of day or night to get it restored.

Password has been forgotten:

To have your password clue emailed to you or to reset your password, go to the Forgot username or password? link at the bottom of the home page Login box and select password.

What should I do when I forget my password?

From the online banking login screen, you can do the following:

You may recover your password by clicking on the Forgot your password? link that appears beneath the field where you would normally enter your password.

Fill out the form with your Username and Social Security Number.

Alternatively, you can choose to have your password clue emailed to the address you supplied for your account by selecting Email my password hint from the drop-down menu. To establish a new password online, you must first create a new password on your computer.

Where’s my online banking trusted image?

We’ve made it easier for you to access your bank accounts by streamlining the process. You no longer need to enter your login and password on separate screens, and you no longer need to authenticate your identity with a trusted image (formerly called the SafeKeys image). As is always the case, you can rest assured that your financial information is safe. In the event that we require additional verification, we will still issue you a security code to ensure it is you.

What’s a Security Code in Online Banking?

This 6-digit number is something you can request from us via text message or email if you log into your account from a device we don’t recognise. After being sent, the code can only be used once and will expire 20 minutes after it is received.

How do I set up my login information as a joint account owner?

Enrolling in an Ally Bank, Ally Invest, or Ally Auto joint account online will allow you to create your login credentials for your account.

How long do Security Codes take to arrive?

It is dependent on how the code was transmitted. It may take a few minutes for an email to arrive if it was sent through email (remember to check your SPAM folder). If the code was sent as a text message, it will usually arrive within a few seconds of sending the message. If your package has not yet arrived, try mailing it again. In the event that you have configured another method of receiving security codes, you can try sending the code to that email address or phone number.

Should I save the Security Code?

No. Because this is a one-time use code that was produced at random, you will not be required to use it again.

How can I change where the security code is sent?

You may access online banking by selecting your name (or Profile, if you’re using your mobile device), then Profile and Settings from the drop-down menu. To change your delivery options, select Security Code Delivery from the drop-down menu. You won’t be able to modify where you receive security codes until you input your password, which is done for your protection.

What carriers are supported to receive a Security Code via a text message?

At&t Wireless, Verizon Wireless, Sprint, T-Mobile®, Alltel, Nextel, Boost, U.S. Cellular, MetroPCS, nTelos, ACS Wireless, Bluegrass Cellular, Cellular One of East Central Illinois, Centennial Wireless, Cox Communications, Cox Wireless, Appalachian Wireless, GCI Communications, Golden State, Illinois Valley Cellular, Keystone Wireless, Inland Cellular, NEPA, Nex-Tech Wireless, Thumb Cellular.

Should I register this computer in Online Banking?

Depending on the type of computer you are using, the answer is different. You should register any personal computers that you use on a regular basis, especially if you use them regularly. If you are using a friend’s computer or a computer that is open to the public, you should refrain from registering it.

Which browsers work best with online banking?

Unsupported browsers may cause performance issues on the site or prohibit you from logging in altogether. For the greatest performance when utilising a desktop computer, we recommend the following:

Chrome 90 or above is required (Google)

Firefox 88 or higher is required (Mozilla)

Safari 14 or higher is required (Mac)

Microsoft Edge 90 or higher is required (Microsoft)

Can I register more than one computer in Online Banking?

Yes. You are permitted to register an unlimited number of machines. To register a second computer, simply log in from that computer. The option to register the computer will be presented to you when you have entered your security code successfully.